Accounting Office Business Plan (Example)

Table of Contents

According to industry research, about 50% of small accounting firms fail within their first year. This is often due to poor business planning, lack of market position, or unclear service offerings. But, you also have the flip side of the that, where are modest accounting startups that grew into thriving firms with loyal client bases and multi-million-dollar revenues. This is because they began with a well-structured business plan. Firms don’t success by accident, they succeed because they start with a solid foundation.

Our guide will offer you the blueprint on how to create a winning accounting office business plan and succeed. You can create a business that aligns with teams, impresses investors and accelerates growth. Whether you’re starting fresh or refining your existing vision, this plan takes the mystery out of business planning—and replaces it with clarity, confidence, and control.

Why Your Accounting Office Needs a Bulletproof Business Plan?

“According to the U.S. Small Business Administration, nearly 20% of businesses fail within the first year—and by year five, roughly 50% have shut down. For accounting firms, compliance burdens, competition, and client retention make the odds even steeper.” — AICPA & SBA Data Insights

There is a lot more that goes into opening an accounting office, it’s not enough to just balance books. You have to navigate regulatory red tape, earning client trust, and building credibility from scratch. Accounting faces unique problems, that other businesses get to avoid. An accounting office face complex compliance requirement, licensing hurdles, and an uphill battle to differentiate in a saturated market. So, without a clear blueprint, it can be hard to stall before ever gaining any real momentum.

I used to work for two start-up companies that were both established by gifted certified public accountants. One created a strategic plan outlining pricing levels, marketing channels, and service offerings. Without one, the other leaped in. The planner turned a profit and grew within 18 months. Due to erratic cash flow and unclear direction, the other store quietly closed.

So, regardless of whether you have assembled a small team or are starting solo, well-crafted business plan isn’t optional. This business plan is your survival kit. It will help you make smarter choices, anticipate any challenges, and securing partnerships with confidence. If you’re still weighing the logistics of launching, be sure to read our comprehensive business startup guide for foundational steps every entrepreneur should take.

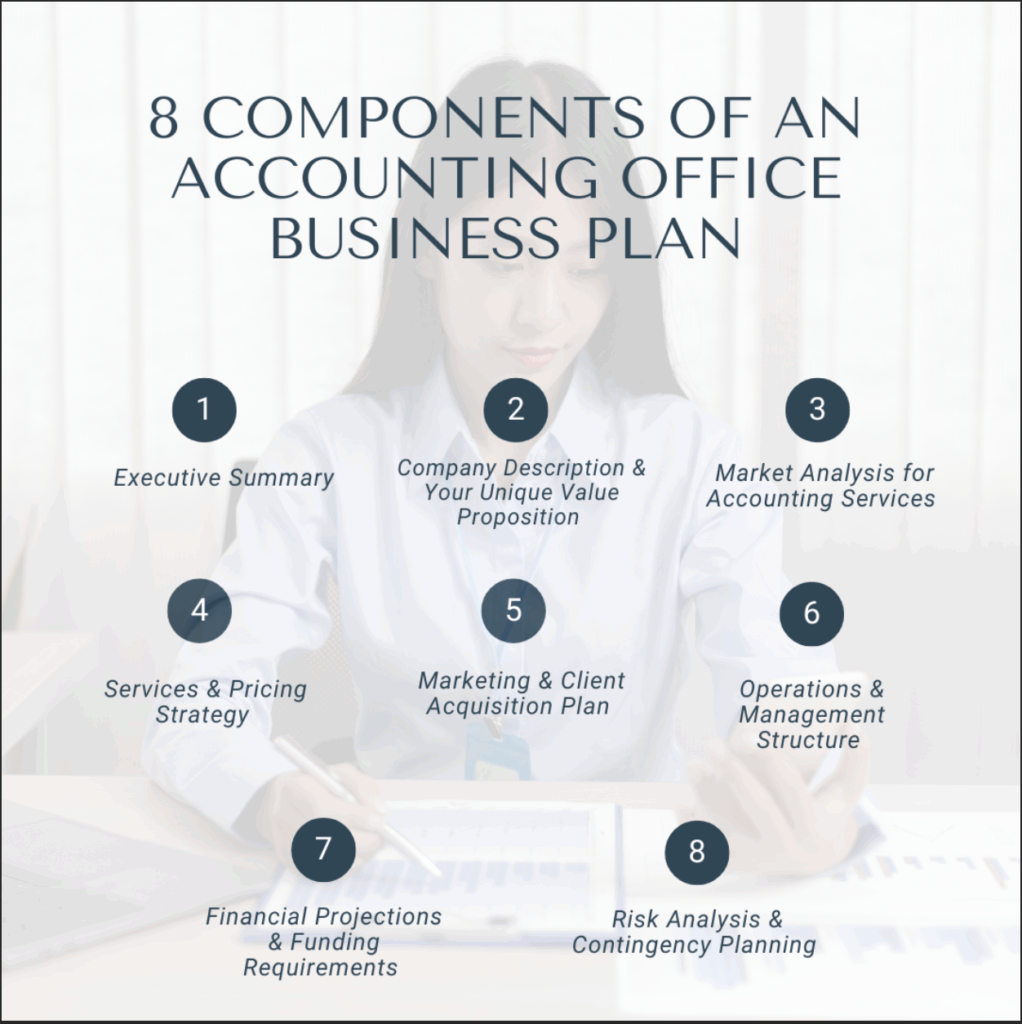

The 8 Essential Components of an Accounting Office Business Plan

Let’s bust a myth that a business plan is not a checklist. A business plan is used to address the unique demands of the financial services industry. It should include regulatory compliance, ethical standards, recurring revenue models, and trust-based client relationships.

Below, we break down the eight must-have components that go beyond boilerplate templates to help you craft a high-impact, industry-specific plan.

Executive Summary That Sells Your Vision

Your executive summary needs to grab someone’s attention, because sometimes that’s the only thing people look at. As an accounting practice, this will mean that you need to clearly articulate your niche, service offerings, your target market and growth strategy, in one mighty powerful page.

Any investor or lender will look for measurable potential, so include key financial projections. An example of this can be Year 1 revenue goal, client acquisition cost, and expected EBITDA margin.

Also, you should include credentials that establish credibility, like CPA licensing, prior experience, or client testimonials. Make sure to identify what is unique about your firm: Are you tech-savvy? Do you know what it is like to work with a small business? Have special services like forensic accounting or CFO advisory? A strong executive summary shows a very confident assessment of your firm’s future and it shows the readers that you are clear on how to get there.

Company Description & Your Unique Value Proposition

When writing a company description, you are setting the stage for why your accounting firm exists and who it aims to serve. You need to go beyond surface level information to define your firm’s core identity, strategic positioning, and unique strengths in a crowded marketplace.

You want to start by stating your business structure whether that be sole proprietorship, partnership, or PLLC. Also, include an ownership background and founder’s story. The next step in writing your company description is to include your specialization strategy. So are you targeting startups, freelancers, nonprofits, or mid-market enterprises? The more specific, the better. If you are positioning your company in a niche aspect such as outsourced bookkeeping for SaaS companies, it will make it easier to attract clients and build referral networks.

You should also have a Unique Value Proposition (UVP). This should answer the question:

Why should someone choose your firm over a dozen others?

This could be because you offer real-time reporting technology, your fixed-fee pricing model, or your white-glove advisory services. Our professional tip is to frame your UVP around the pain points of your target audience and how your services will solve them.

This section you want to center it around how you stand out and create value in a hyper-competitive space.

Market Analysis for Accounting Services

When you present a strong market analysis, it demonstrates that you have a good understanding of the environment that you are entering. You have been able to clearly identify an opportunity within it. As an accounting firm, this means you know who your ideal clients are, how they are currently being served, and finally how your company can fill the gap in the market.

You want to start with a local market analysis. So if you are based in the US this may include using data from the U.S. Census Bureau, Chamber of Commerce, or platforms like IBISWorld to assess the volume and type of businesses in your area. See if there are clusters of small businesses, startups, or professionals in need of bookkeeping, tax, or advisory services? During this step you can also conduct surveys or casual conversations with business owners to uncover pain points and service gaps.

The next step you want to perform a competitor analysis. List out direct competitors—local firms, franchises, and virtual accounting providers—and assess their service offerings, pricing, strengths, and client reviews. You can use tools such as Yelp, LinkedIn, Google reviews, to gain insights into where they shine and where they fall short.

A key tip is for you to look for underserved niches. Identifying a focused, underserved market gives you a chance to position your firm not just as another provider—but as the go-to expert for that audience.

Services & Pricing Strategy

Now it’s time to clearly structure your services and pricing strategy. Both of these aspects are essential to build trust, manage expectations and ensure that your business is profitable.

The bottom line in the accounting world is how you package and price your offerings can make or break client acquisition. You can start by outlining your core services so this may include:

- bookkeeping,

- payroll processing,

- tax preparation,

- audit support,

- or outsourced CFO services.

You may consider offering tiered pricing packages to target various clients and budgets. This way you cast a wider net of customers you can acquire and thus boost your profits. Also, it streamlines your operations and gives clients clear choices and manages their expectations.

When structuring your pricing model, you need to make sure it aligns with your business and customers. Some popular options include:

- Hourly billing offers flexibility but can create uncertainty for clients.

- Flat fees are transparent and attractive for routine services like monthly bookkeeping or tax filings.

- Retainer models provide predictable revenue and work well for ongoing advisory or compliance work.

Also, make sure to keep in season factors, so during tax season you will see an influx in revenue; you may need to hire temporary staff. But also, there may be downtime where you have less work and less profit.

Some other things that you can consider is premium pricing for rush jobs or off-cycle filings, and offer off-season services like tax planning or budgeting consultations to smooth out cash flow.

Marketing & Client Acquisition Plan

Your accounting company’s success doesn’t depend solely on your technical skills. In fact it is more dependent on your ability to consistently attract and retain ideal clients. You need to have a strong marketing and acquisition plan to help you boost online visibility, build trust and personal connection.

The best way to start is with a digital marketing plan. Some foundational elements of your marketing plan should include:

- Professional website that highlights your services, credentials, and client testimonials. Make sure to use SEO strategy to grow traffic to your website. You can create blog content about tax tips, financial planning, or industry-specific accounting advice.

- Considering using paid ads to further boost visibility

- Also, use social media platforms like LinkedIn and Facebook, they also offer paid ads

As part of your acquisition plan you can also tap into referral systems. This is one of the most powerful tools for accounting firms to build client relationships. Also, provide existing clients with referral bonuses, and cultivate connections with lawyers, business advisors, and real estate agents who cater to similar clientele. These reliable networks have the potential to develop into reliable lead sources.

Never underestimate the power of professional networking. Join local chambers of commerce, BNI groups, or industry-specific associations. Speak at business events or webinars to showcase your expertise.

A well-rounded marketing plan will not only bring in clients, but it will also, build authority, reputation and long-term brand equity.

Operations & Management Structure

Just like behind every fast car is a high-powered engine, behind every accounting firm there is a well-oiled operational engine. This is a system that keeps clients work on track, ensures accuracy, and supports scalable growth. This section in your business plan should outline how your firm will function day-to-day. It should include who’s in charge of what, and what tools and systems will power your service delivery.

Start by detailing your workflow system. So how will client work be assigned, tracked and reviewed. You may use popular tools such as Jetpack Workflow, Karbon, or Canopy to help automate these tasks and manage your workflow system. Also outline common operating procedures such as monthly bookkeeping or tax filings to ensure consistency and efficiency.

Now, you can specify your software stack; this may include tools like QuickBooks Online or Xero to manage client documents and create client portals. You may also consider adding CRM software. Finally, if you are working remotely, you should also add communication tools like Slack, Zoom, or Microsoft Teams.

Next up, you need to have a management structure that should clarify roles and responsibilities. Explain who will be handling tasks such as client communication or compliance. Now, if you are starting solo, describe if you have any hiring plans.

Finally, make sure to emphasis your quality control process. Double-review procedures, peer audits, and clear client deliverable checklists. In order to show investors and partners that your firm is built to uphold accuracy, security, and professional standards.

As an accounting firm, precision needs to be your brand and your operations need to reflect that.

Financial Projections & Funding Requirements

So investors, lenders or any potential partners, only want one thing in this section. And that is, proof that your accounting company can be financially viable and scalable. So, you need to lay out realistic projections, a smart budgeting strategy and finally a clear picture of your startup and operational funding needs.

Step 1: Start with revenue forecasting. So you want to estimate your income based on your pricing model, projected number of clients and service mix. You want to be conservative your first year and show growth gradually over 3 to 5 years.

Step 2: Create a detailed expense budget. You can include costs such as rent, software subscriptions, insurance, and salaries. Also, add in costs such as marketing, continuing education, and seasonal staffing. Don’t forget to mention costs associated with professional dues, compliance costs, and tech upgrades.

Step 3: Build a cash flow projection to show how you will manage the various seasons of income. For example, you will experience a spike in finances during tax season, but your income may be lower in the summer. You can mention strategies that you will be using. These strategies may be offering advisory retainers, pre-payment discounts, or off-season services to smooth out revenue.

Final step: Outline your startup capital needs. You need to show how much it will take to launch and sustain your business, before it becomes profitable. Make sure to include costs such as licensing, legal fees, branding, office setup, and initial marketing. Also, if you know how you will fund it, make sure to include that. So, whether you are using personal saving, a loan, investor capital, or grants. Don’t forget to mention how that capital will be allocated.

Risk Analysis & Contingency Planning

So, every business carries a certain amount of risk. Accounting companies face a distinct blend of compliance pressure, reputational stakes, and operational vulnerabilities. All these factors, make proactive planning a necessity. In this section you want to prove that you are prepared for not just success but also any potential setbacks.

You want to start with professional liability as this is the most immediate risk in the accounting industry. A single error in tax filing or financial reporting can lead to client losses or lawsuits. You want to show that you protect your business with Errors & Omissions insurance. Also, by including internal review processes to catch mistakes early, and providing ongoing training to our team to reduce human error.

Another risk is an economic downturn like a recession. During this time clients may scale back on services or may have issues with payment. You need to show that you kept this in mind by presenting a contingency budget. Perhaps, you may even offer scalable service tiers, and maintain a cash reserve to sustain operations through lean periods. Another option is to offer a diverse set of services that can help during a recession, such as debt planning, cost-reduction consulting, or forensic audits.

Another common threat among accounting companies is regulatory changes. There may be new tax laws, compliance standards, or licensing requirements that can directly impact your services and workflow. You can stay ahead by subscribing to industry alerts, and you can also participate in quarter for training and policy updates.

The final thing that you need to cover in this section, is what if there is a technology disruption. I mean you may experience a blackout, or software outage or perhaps a cybersecurity attack. So, how are you going to safeguard against some of these threats. You can implement things like secure, cloud-based accounting tools with redundant backups and MFA (multi-factor authentication). You should have a recovery disaster plan and a client communication protocol in case of any service interruptions or security breeches.

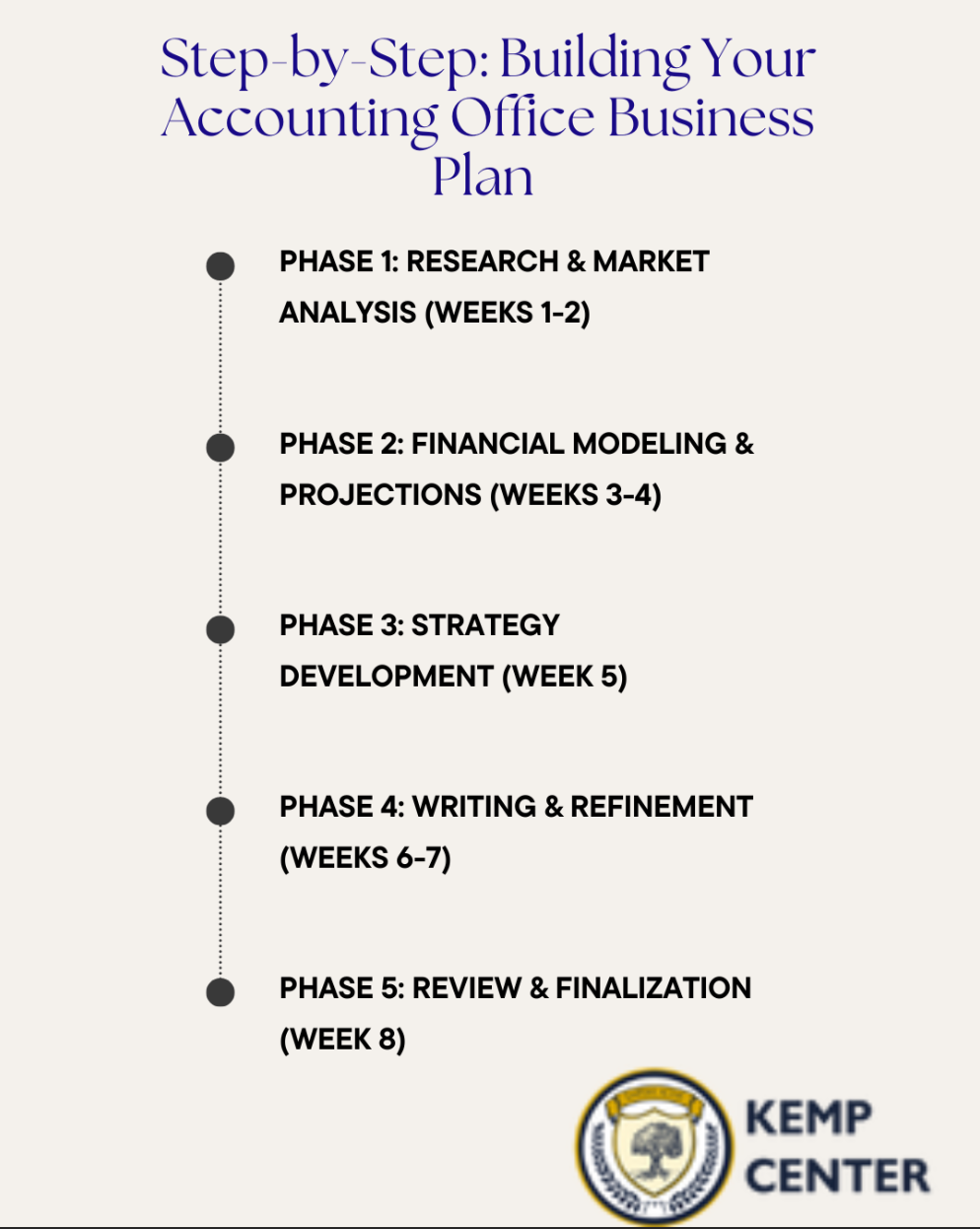

Step-by-Step: Building Your Accounting Office Business Plan

So, you probably won’t create a business plan in one day. This is a structured task that is going to help you have success with your accounting firm. Why don’t we break down the journey to together into smaller tasks. This way it’ll be easier for you to stay focused, organized, and aligned with your long-term goals. Follow us on through a chronological map, complete with timeframes, research methods, writing tips, and pitfalls to avoid.

Phase 1: Research & Market Analysis (Weeks 1-2)

Before you think about writing even a single sentence for your business plan, you need to do some deep research. In this phase you want to lay the groundwork so that you can make informed decisions about services, prices, marketing, and so much more.

There are a few market research techniques that you can use such as:

- You can analyze the local market with tools such as U.S. Census Bureau’s Business Builder, IBISWorld, or Statista to find out how many small businesses, freelancers, or nonprofits exist in your area—and what services they typically use.

- Try to reach out to potential clients to do surveys and interviews. This way you can gain a picture of what is on the market and if there are any pain points. This firsthand data is gold when tailoring your offerings.

- Next thing that you can try is online communities such as Reddit, QuickBooks Community, or LinkedIn groups. You will often see real-time business owner challenges and gaps in current accounting support.

Another aspect that will come in handy during your research is competitor analysis tools:

- You can use tools such as Google Maps, Yelp, and even LinkedIn to identify competitors in your local region.

- Make sure to evaluate their websites for service offerings, pricing, client reviews, and specializations.

- You can create a competitor’s matrix. In this matrix, columns for pricing, strengths, weaknesses, certifications, and client segments are included.

You should also include demographic studies in your research:

- For an accounting firm you want to identify high-opportunity industries in your region. So, this could be real estate, e-commerce, law firms, etc.

- You can also review demographic data such as age, business type and income. This way you can align your services to a growing or underserviced sector.

Now let’s dive into 3 common mistakes to avoid when doing your research:

- You skip local market research and go straight to national research. For accounting firms, a lot of their business is from local clients.

- You should never assume demand without any validation. Any business decisions should be backed by data, avoid running on assumptions or intuition.

- Don’t underestimate your competitors. Even a solo practitioner can have a strong local following or digital reach.

Now it’s the end of the week 2 you should have a clear picture of your target market, competitive landscape, and service gaps. This is the core intelligence that will drive the rest of your business plan.

Phase 2: Financial Modeling & Projections (Weeks 3-4)

Now let’s take all that research that you have done and turn it into valuable insight. This phase is where you build a financial roadmap that not only proves your accounting office can thrive. It also prepares you for the unexpected.

So, you can start by creating realistic financial models. You can project your monthly and annual revenue based on your services, pricing, and estimated client volume. Here is how you can break this down:

- Service category

- Pricing model

- Client type or niche

You want to start off conservatively, as business is usually the hardest in the first 12 months. After that you can slowly grow these projections. Make sure to reflect realistic acquisition rates as well, when it comes to your client base.

Next thing you want to do is compare your projections against industry standards. You can use resources like IBISWorld, NAICS industry reports, or data from the AICPA. This way you can benchmark:

- Gross profit margins (typically 40–60% for small firms)

- Billing rates per service tier

- Average client lifetime value

- Annual client loss or churn rate

These numbers will ground your business in reality and make your plan more credible to investors and lenders.

You also want to do some scenario planning for your business plan. By using ‘what-if’ scenarios you can stress test your business. Ideally, you should model at least three financial scenarios. The first scenario is your baseline, so your expected performance. The second scenario is optimistic, where you have higher than expected growth and performance. And the final scenario that you want to include is a conservative one, where perhaps you have less client acquisition than you expected or higher client loss.

Also, include a cashflow forecast for the first 12 months. In this section you want to highlight how you’ll manage slow periods (post-tax season) or fund growth spurts.

Now, here are some common mistakes that you want to avoid in this section of your business plan:

- Overestimating early revenue. You will need 6 to 12 months for the company to build some traction.

- Don’t forget about fixed costs such as insurance, software, and licensing.

- Also, don’t forget taxes or owner compensation in projections.

At the end of week 4 you should have a clean, professional spreadsheet that shows a realistic, data-driven financial future for your accounting company. You should impress investors, lenders and other stakeholders with your data-driven business plan.

Phase 3: Strategy Development (Week 5)

Now that you can check off the research and finance section of your business plan, it’s time to move ahead to building a strategic backbone. In this phase, you want to focus on your company’s competitive edge and outline how you plan to grow in a competitive market.

First, you want to identify your position in the accounting field. So perhaps you are going to be that tech savvy accountant who is the ideal choice for startups. Or maybe you want to be the go to tax strategist for real estate investors. Whatever your niche is, use a simple position formula like this one:

“We help [target market] solve [key problem] through [your unique solution].”

This statement will guide your messaging, marketing, and service development.

Your next step will be to provide service differentiation. You want to do more than just list your services. How will your company provide them in a unique way?

- Provide fixed-fee packages or subscription-based pricing to foster trust and clarity.

- Create flawless client experiences by utilizing contemporary tools (such as Xero, Gusto, and Hubdoc).

- Stress the extras, such as proactive deadline alerts, quarterly strategy calls, or customized tax planning.

Consider yourself a product designer and consider how you can package your accounting services to make them more valuable, easier to use, or less stressful than those of your rivals.

Next you want to lay out your growth plan, both short term and long term. For your short-term plan, you want to focus on the first 2 years. The focal point should be organic growth via referrals, local networking, and niche marketing. Next show mid-term so about 3 to 5 years in. At this point consider expanding into advisory services, hiring junior staff, or targeting adjacent niches. Finally, long term, which is over 5 years, this will be franchising your brand, acquiring smaller practices, or pivoting into outsourced CFO work.

Here are some common mistakes to avoid:

- Being vague about your niche or trying to serve everyone.

- Ignoring delivery methods—how you serve clients is as important as what you offer.

- Failing to plan for scale—a strategy without growth steps is just wishful thinking.

Phase 4: Writing & Refinement (Weeks 6-7)

Now it’s time to put everything together. Here is where everything merges—your research, financials and strategy are fully integrated into a clear, professional business plan that is ready for banks, investors, partners, or personal execution. The importance here is to write clearly, format with intent, and refine for the greatest effect.

So what you want to do is use:

- Short paragraphs and concise language

- Active voice, for example “We will offer fixed-fee bookkeeping packages”

- Let your data, research and projections do the convincing.

You need to make your business plan skimmable and easy to navigate. Make sure to use headings, add a table of contents, add charts or graphs (for finances) and use a professional font.

Consider exporting your document to PDF, as it’s easier to share electronically, and it will help you keep your formatting.

Phase 5: Review & Finalization (Week 8)

Congrats, your business plan is finally written. Now it’s time for that final review. This phase ensures your plan is not only accurate and compelling but also presentation-ready and professionally polished. Getting outside input and refining your final product is what turns a “good plan” into a credible, high-impact blueprint for your accounting office.

Here is a quick way to do this:

- First schedule a feedback session with 2 or 3 trusted professionals. Ideally this would a certified accountant, a small business owner and your mentor. Ask them to provide you with feedback

- Use a checklist to ensure accuracy of important aspects such as financials, market positioning, competitive analysis, and consistency.

- Prioritize edits that improve flow, remove redundancies, or clarify strategy. Avoid “over-polishing” by keeping your voice natural and your content grounded in your research.

- Prepare for your presentation. You can create a slide pitch deck to present at meetings with stakeholders, lenders and investors. Practice a 3 minute pitch of your executive summary. Finally, have printed copies in binders, ready to go.

- Last step is to create a backup plan and manage version control.

Here is a table to help you gain a better idea of how long each step should take you and the level of difficulty:

Task | Time Estimate | Difficulty |

Peer Review & Feedback | 2–3 hours | 🟨 Medium |

Final Edits & Proofreading | 4–6 hours | 🟩 Easy |

Presentation Prep | 3–4 hours | 🟥 High |

Financial Projections That Actually Work

Avoid making best case guesses when creating your financial projections. You should be presenting a credible, data-driven forecast that shows how your accounting firm will perform, sustain itself, and scale. Regardless of whether this is self-funded, from a lender or investor, this section of your business plan proves you understand how money moves through your business.

As an accounting firm you need to build a realistic revenue model around monthly retainers, tax preparation, and advisory services. You need to be realistic and conservative about early estimates. Make sure to keep in mind client acquisition time and peak seasons along with slow seasons. Business is often like a rollercoaster, it’s important to remember the peaks and valleys along with everything in between.

A simple break-even analysis can clarify your monthly revenue target, while three growth scenarios—baseline, optimistic, and conservative—help investors understand your range of outcomes. Don’t overlook cash flow timing: even profitable firms can struggle if payments cluster around deadlines. Aim to show not just what you’ll earn, but when and how you’ll stay profitable.

Make sure to use trusted sources such as SBA financial planning tools and accounting salary guides to strengthen your assumptions. With solid projections, your plan will feel less like a roulette wheel and more like a strategy.

Common Business Plan Mistakes

There is a good old saying by Robert Burns that states even “the best-laid plans of mice and men often go awry.” This just means that even the most carefully constructed plans can fall apart or fail due to unforeseen circumstances.

Here are seven common mistakes accounting firms make and how to avoid them:

- Avoid overestimating revenue early in your business. Make sure to use conservative projections and factor in ramp up time.

- Avoid having a vague target audience or market. You need to define your niche, you are more than just a small business.

- Not having a clear marketing plan. You can’t just rely on referrals. You need to reach your clients through SEO or paid ads

- Don‘t omit cash flow information. Failing to show the exact date payments come in renders a listing’s revenue irrelevant. Highlight seasonal trends along with cash buffers.

- Don’t use a weak executive summary. If your intro doesn’t clearly state your value and financial potential, most readers won’t go further. Lead with clarity and impact.

- Don‘t ignore things like licensing, insurance, or state regulations shows poor planning. Add a section addressing professional requirements.

- Your business has risks, just like the millions of others out there. Don’t avoid risk planning. Show investors you’re ready by naming your top threats and how you’ll manage them.

Fix these early, and your plan will be sharper, more credible, and far more fundable. For more help, check out our business planning resources and entrepreneurship toolkit.

Frequently Asked Questions

How long should an accounting office business plan be?

Typically an effective business plan will range anywhere from 12 to 20 pages. You want to focus on clarity not length. What matters is that you cover all key areas without the extra fluff.

What is the average startup cost for an accounting office?

So your startup cost will vary depending on two things your location and whether you are going solo or running a small business. So here are a few examples:

- In the UK for solo setups you are looking at a cost of £3,000–£8,000. Now as a small business that cost may be £8,000–£15,000+.

- On the other hand if you are in the United States, as a solo setup you are looking to spend around $5,000–$10,000 for startup costs. If you are going the small business route you may be looking at costs around $10,000–$20,000+.

- Finally, if you are based in the Eurozone, as solo startup you will likely have to pay around €4,000–€10,000. Whereas, for a small business the cost will be closer to €10,000–€20,000+

Do I need a business plan if I’m just starting as a solo practitioner?

Yes. Even as a solo practitioner, you need a business plan. It helps define your niche, pricing, and marketing so you can grow with purpose.

How often should I update my accounting office business plan?

Review and update your plan at least once a year, or whenever there’s a major shift—like expanding services or seeking funding.

What financial projections do investors want to see?

You should include revenue forecasts, expense breakdowns, cash flow projections, and a break-even analysis. Show both realistic and growth-oriented scenarios.

Can I use a generic business plan template for my accounting department?

You can, but it’s better to use one tailored to accounting services. Industry-specific details like compliance, client retention, and seasonal income patterns matter to lenders and partners.

Summary

Now you have all the necessary information to create a business plan that will impress investors and guide your accounting practice to sustainable success. he three pillars of every winning accounting office are:

- Strategic positioning

- Solid financial planning

- And operational excellence

The main difference between accountants who find success and those who don’t usually lies in how consistently they act on their plans. A business plan isn’t just something to file away; it should help guide your daily choices, whether you’re setting prices or making hiring decisions. With the right framework and tools for your business plan, plus expert guidance from Kemp Center, it’s time to build the management skills that can really elevate your accounting practice.

Ready to master the leadership and operational skills that turn business plans into business success?

Our comprehensive Business Management Course teaches you the crucial management techniques, team leadership strategies, and analytical thinking skills that every successful accounting office owner needs to thrive.

Want to ensure your accounting practice stands out in a crowded market?

Check out our Digital Marketing Course where you’ll discover how to attract high-value clients through strategic online marketing and build a marketing system that works 24/7 for your practice.